TODAY WE WILL DISCUSS IMPORTANCE OF FINANCIAL PLANNING

5 GOLDEN RULES OF FINANCIAL PLANNING

These financial tenets shall never change or become irrelevant. Follow them if you want to protect your finances against uncertainty.

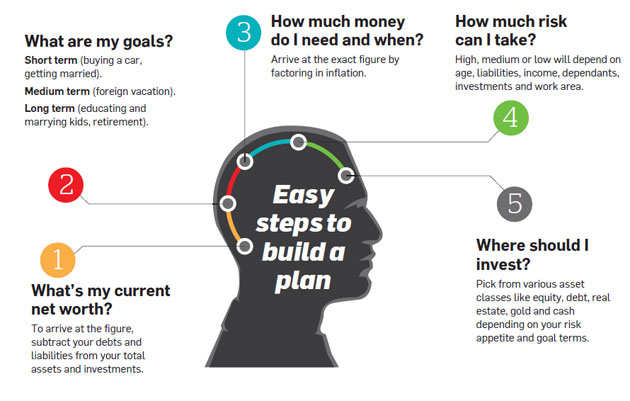

Have a plan, be rich

This is, perhaps, one virtue that can neutralise the impact of various financial sins.

A plan acts as a guide through your financial journey and, even if domestic and global upheavals dent your investments, it will help you get back on track.

At the macro level, planning affects every aspect of personal finance,

be it taxation, insurance or achievement of goals.

It can cut losses, enhance gains, and avoid the pain and panic of a financial or lifestage crisis. At another level, a plan is a simple matter of listing out your needs and wants, and deploying the money in right avenues so that you have it when you need it. As a first step, calculate your existing worth and identify the goals for which you will require money in the future. Calculate the exact amount required for each goal after factoring in inflation and the time horizon in which you want it.

Link your investments to goals and you won't have to scrounge around for money when you need it. Build a plan the minute you are employed because you can invest without straining your finances and without the burden of responsibilities.

Secure your family & finances

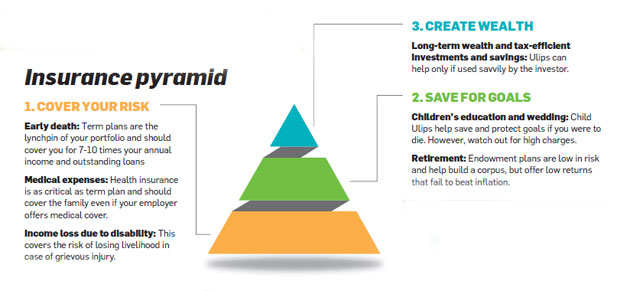

Most people are so intent on investing and building assets that they forget to cover their risks. Since it's crucial to secure your family and finances by creating an adequate insurance portfolio, this is the second constant that does not change with time. A majority of the people buy insurance to save tax and as an investment, with life insurance the second most favoured investment destination after fixed deposits, accounting for 25% of the wealth of small investors.

However, it's important that you don't mix your insurance and invesments. The base of your insurance pyramid should comprise pure protection plans. These cover the risk of death (term plans), health issues (medical plans) and accidents.

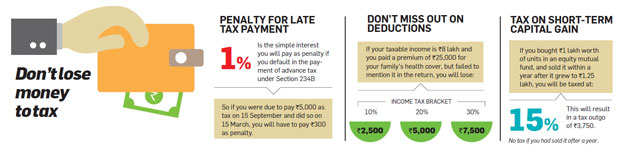

Never ignore taxes

Much like death, taxes will never go away. While rules and slabs may change from time to time, taxation itself won't. In fact, it affects every aspect of your finances, from income and allowances to investments as well as the assets you buy or sell. So, stop ignoring or pushing it away.

Look at it as a way of reducing your losses and increasing your gains. Take the help of a planner or tax professional if you need, but start on time. Split it into three sections—taxsaving investments (deductions/exemptions), tax payment and filing of returns. Make a calendar for each because procrastinating will not only result in confusion, but also losses and penalties. Plan your tax-saving investments at the beginning of the financial year by calculating how to maximise exemptions and deductions under various sections. So if you are paying the tuition fee for two children, investing in the PPF, and having your EPF deducted from the salary, it is likely that you will exhaust your Section 80C limit of Rs 1.5 lakh and won't need to rush into the last-minute purchase of an endowment plan or Ulip that you don't need.

Monitor your investments

Creating a plan and building a portfolio may go to waste if you do not monitor it periodically. A review is essential to mark the progress towards your goals and take corrective measures, if required. As critical as a medical check-up, you should monitor the investments on a quarterly basis for short-term goals, and annually for long-term goals. While some people display undue exuberance, checking twice a week or more, it is prudent to do it at longer intervals. In changing market conditions, an important thing to analyse is the asset allocation, which could have changed and will need to be rebalanced.

Be aware, stay alert

The more things change, the more this rule holds. A good financial plan not only means investing in the right avenues and monitoring the plan's progress, but also ensuring that you don't lose your hard-earned money to frauds, identity theft and sheer ignorance. Financial knowledge and caution can translate into higher gains and fewer losses for you in any market condition.

You can start by taking note of the various fees and charges that are straining your budget and reducing your savings. Whether it's credit card usage or travel planning, banking or realty transations, make sure you don't give away more than you should. Next, ensure you don't invest in an instrument you know nothing about, especially when it comes to stock investments.

CONCLUSION :-

It is important to do financial planning and that too as early as possible whereas at the same time be conscious and aware of where you put your hard earned money.

THANK YOU.

AND WISHING ALL THE READERS A VERY HAPPY DUSSHERA.

5 GOLDEN RULES OF FINANCIAL PLANNING

These financial tenets shall never change or become irrelevant. Follow them if you want to protect your finances against uncertainty.

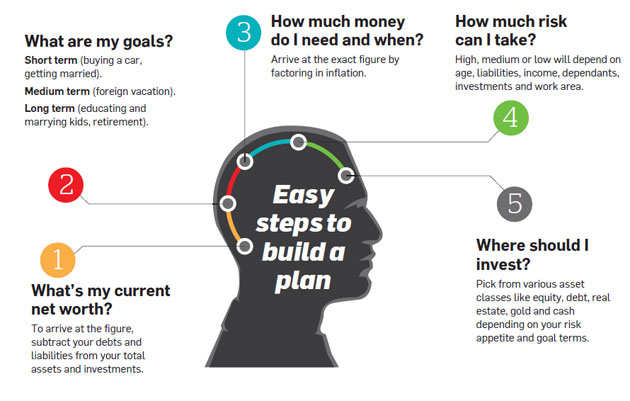

Have a plan, be rich

This is, perhaps, one virtue that can neutralise the impact of various financial sins.

A plan acts as a guide through your financial journey and, even if domestic and global upheavals dent your investments, it will help you get back on track.

At the macro level, planning affects every aspect of personal finance,

be it taxation, insurance or achievement of goals.

It can cut losses, enhance gains, and avoid the pain and panic of a financial or lifestage crisis. At another level, a plan is a simple matter of listing out your needs and wants, and deploying the money in right avenues so that you have it when you need it. As a first step, calculate your existing worth and identify the goals for which you will require money in the future. Calculate the exact amount required for each goal after factoring in inflation and the time horizon in which you want it.

Link your investments to goals and you won't have to scrounge around for money when you need it. Build a plan the minute you are employed because you can invest without straining your finances and without the burden of responsibilities.

Secure your family & finances

Most people are so intent on investing and building assets that they forget to cover their risks. Since it's crucial to secure your family and finances by creating an adequate insurance portfolio, this is the second constant that does not change with time. A majority of the people buy insurance to save tax and as an investment, with life insurance the second most favoured investment destination after fixed deposits, accounting for 25% of the wealth of small investors.

However, it's important that you don't mix your insurance and invesments. The base of your insurance pyramid should comprise pure protection plans. These cover the risk of death (term plans), health issues (medical plans) and accidents.

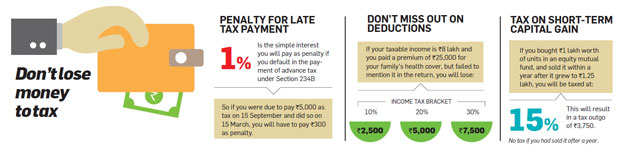

Never ignore taxes

Much like death, taxes will never go away. While rules and slabs may change from time to time, taxation itself won't. In fact, it affects every aspect of your finances, from income and allowances to investments as well as the assets you buy or sell. So, stop ignoring or pushing it away.

Look at it as a way of reducing your losses and increasing your gains. Take the help of a planner or tax professional if you need, but start on time. Split it into three sections—taxsaving investments (deductions/exemptions), tax payment and filing of returns. Make a calendar for each because procrastinating will not only result in confusion, but also losses and penalties. Plan your tax-saving investments at the beginning of the financial year by calculating how to maximise exemptions and deductions under various sections. So if you are paying the tuition fee for two children, investing in the PPF, and having your EPF deducted from the salary, it is likely that you will exhaust your Section 80C limit of Rs 1.5 lakh and won't need to rush into the last-minute purchase of an endowment plan or Ulip that you don't need.

Monitor your investments

Creating a plan and building a portfolio may go to waste if you do not monitor it periodically. A review is essential to mark the progress towards your goals and take corrective measures, if required. As critical as a medical check-up, you should monitor the investments on a quarterly basis for short-term goals, and annually for long-term goals. While some people display undue exuberance, checking twice a week or more, it is prudent to do it at longer intervals. In changing market conditions, an important thing to analyse is the asset allocation, which could have changed and will need to be rebalanced.

Be aware, stay alert

The more things change, the more this rule holds. A good financial plan not only means investing in the right avenues and monitoring the plan's progress, but also ensuring that you don't lose your hard-earned money to frauds, identity theft and sheer ignorance. Financial knowledge and caution can translate into higher gains and fewer losses for you in any market condition.

You can start by taking note of the various fees and charges that are straining your budget and reducing your savings. Whether it's credit card usage or travel planning, banking or realty transations, make sure you don't give away more than you should. Next, ensure you don't invest in an instrument you know nothing about, especially when it comes to stock investments.

CONCLUSION :-

It is important to do financial planning and that too as early as possible whereas at the same time be conscious and aware of where you put your hard earned money.

THANK YOU.

AND WISHING ALL THE READERS A VERY HAPPY DUSSHERA.

No comments:

Post a Comment